Pastel payroll calculator

The hours worked each month vary - this employee worked 133h a rate of 2258h If a employee started working for this company this month earning a gross of R11. Number of days you worked in that month.

Sage Pastel Hr Payroll And Ess

How do I complete a paycheck calculation.

. This number is the gross pay per. Latest software release Sage Pastel Payroll HR 2022 At Sage Pastel Payroll we aim to always provide our customers with stable reliable software. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Monday Tuesday Wednesday Thursday Friday Saturday Sunday. Method 1 Total Cost To Company You are able to use the Total Cost To Company Structure Option to provide a Total Cost Package value as well as setup package components like. Payroll Tax Human Resources Time Labor Management Benefits Insurance Industry.

Employers can use it to calculate net pay and figure out how. Number of public holidays paid hospitalisationsick leave or approved leave if. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Drag Drop No need MR button or copy. Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment. Sage Income Tax Calculator.

Its so easy to. For example if an employee earns 1500 per week the individuals. Payroll Deductions Online Calculator Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

Payroll Deductions Calculator Fine-tune your payroll information and deductions so you can provide your staff with accurate paychecks and get deductions right. All calculation behave just like the original calculator. Single calculator in portrait view.

South African PAYE Calculator PAYE on Monthly Taxable Income PAYE Calculator Tax Year 20202021 - including UIF Monthly Income R Younger than 65 years Between 65 and 75. Up to 15 cash back Hi If i do my pastel payroll calculating a pro-rata salary paid to a person i get a difference pro-rata amount as to the amount work our manually. Calculate how tax changes will affect your pocket Our online tax calculator is in line with changes announced in the 20222023 Budget Speech.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Click here to download the latest. Double calculator in landscape view.

How To Troubleshoot Payroll Tax Calculations In Sage 100 Payroll 2 X

How To Troubleshoot Payroll Tax Calculations In Sage 100 Payroll 2 X

How To Troubleshoot Payroll Tax Calculations In Sage 100 Payroll 2 X

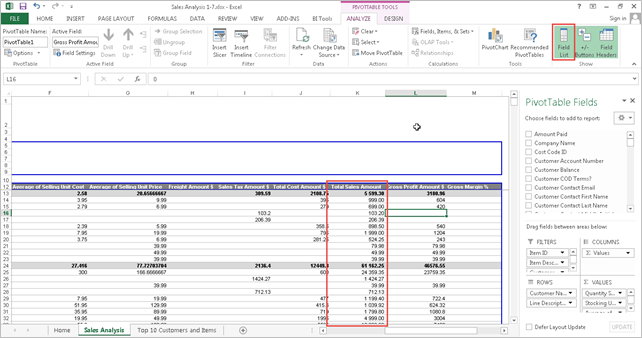

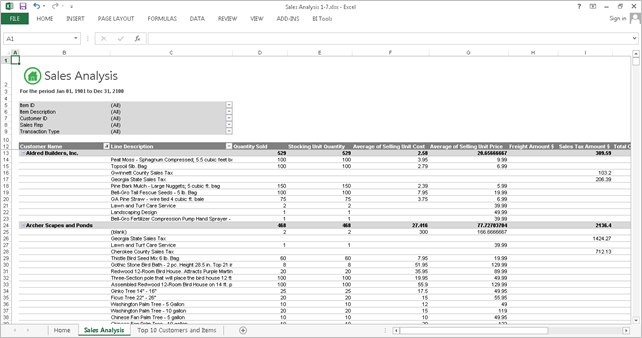

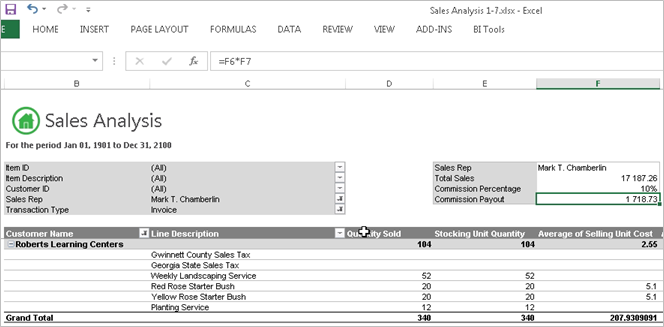

Learn How To Create A Sales Commission Calculator

Sage 50 Learning Payroll Formula

Uif Calculations On Payslip Screen General Discussion Sage Pastel Payroll Sage City Community

3d Minimal Calculator Vector Render Concept Of Financial Management Calculating Financial Risk Planning Calculator With Coins Stack And Arrow Graph With 3d Vector Concept On Pastel Purple Background 6329861 Vector Art At

Leave Calculation General Discussion Sage Pastel Payroll Sage City Community

How To Convert Minutes For Payroll In 3 Steps

How To Troubleshoot Payroll Tax Calculations In Sage 100 Payroll 2 X

Sage Pastel Hr Payroll And Ess

Set Up Custom Calculations

Gross Pay Definition What It Is How To Calculate It Sage Advice Us

Learn How To Create A Sales Commission Calculator

Learn How To Create A Sales Commission Calculator

How To Enter Payroll Taxes Manually

How To Troubleshoot Payroll Tax Calculations In Sage 100 Payroll 2 X