Alternative home financing bad credit

Second mortgage types Lump sum. The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 20072008 global financial crisis.

3 Credit Union Loans For Bad Credit Top Alternatives Badcredit Org

Each state requires its own.

. And possibly one with 0 APR introductory financing. Gather information about your current mortgage. Bankrates experts compare hundreds of top credit cards and credit card offers to select the best in cash back rewards travel business 0 APR balance transfer and more.

Borrow 2000 for 12 months with a 199 representative APR and a monthly repayment of 18363. No matter your credit score if you want to secure tiny home financing in California Texas Colorado or anywhere across the US Acorn Finance. See My Options Sign Up.

The store offers two options. A lower interest rate means you will pay less money toward interest charges as you pay down the balance. About 97 of the.

Getting a bad credit home loan with a low credit score. While your credit score is just one factor mortgage lenders will consider when youre buying a home with bad credit its weighed heavily because it represents your risk to lenders. The ITIN home loan is the program you are looking for and it does not require a social security number.

Search All Cards. However those with poor credit typically receive loan offers no greater than 1000 The website points out that it can connect you to lenders who. You will avoid a credit check high interest rates and monthly payments.

Real estate licenses authorizations issued by state governments give agents and brokers the legal ability to represent a home seller or buyer in the process of buying or selling real estate. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially.

Any time your credit is pulled or your debt is increased you risk your credit score dropping. Let Bankrate a leader. If youre planning a home improvement project read on for six Home Depot financing options.

There are multiple credit scoring models but most lenders use FICO Scores created by the Fair Isaac Corporation. Explore personal finance topics including credit cards investments identity. Different credit-scoring models like VantageScore and FICO use different formulas for determining your scores typically on a scale of 300 to 850 and may identify a specific range as bad credit FICO for example considers scores between 300 and 579 as poor Each lender can also define bad credit differently.

Interested borrowers can choose from various types of business financing including traditional small business loans lines of credit equipment financing and SBA loans. For help with any Bad Credit Loansrelated services feel free to contact us. If you cant find a conventional loan that beats the competition you can fall back to an FHA loan.

It was triggered by a large decline in US home prices after the collapse of a housing bubble leading to mortgage delinquencies foreclosures and the devaluation of housing-related securities. Does financing furniture hurt credit. The following is a representative example of a cash loan APR range.

USDA loans are an attractive alternative for low-to-moderate-income consumers who want to live in a rural or suburban area. If you are an undocumented immigrant and do not have a social security number and need a mortgage to purchase a home there is a program for you. Our specialty is in the acquisition and servicing of automobile retail installment contracts through our large network of franchise and independent automobile dealers.

If you dont have the cash available and are looking for roof financing for bad credit you do have some options. Weve developed a suite of premium Outlook features for people with advanced email and calendar needs. No credit check loans are an option for bad credit borrowers who may have a credit score lower than 560 or that may have too much-existing debt to qualify for a personal loan without a cosigner or without using collateral No credit-check loans come with higher interest rates of up to 36 plus other fees.

The fastest growing Alternative Financing Lender in California Premier Auto Credit is a leading provider of alternative auto financing solutions throughout state of California. But repeat borrowers can qualify for up to 100 points off their next interest rate making it a relatively cheap alternative to other installment loan providers. The best advice for low credit score consumers looking for home financing is to shop around.

Get tiny home financing today without impacting your credit score. The process for applying for a home equity loan with bad credit is similar to getting any other type of mortgage but there are a few extra steps youll need to follow. ITIN Home Loan Program Information.

The best way to finance a roof if you have bad credit is to pay cash if you can. A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

National Business Capital is an online lending marketplace with 75 lenders and a business model similar to Lendios. The loan is secured on the borrowers property through a process. The Definitive Voice of Entertainment News Subscribe for full access to The Hollywood Reporter.

6 steps to apply for a home equity loan with bad credit. Real estate agents and real estate brokers are required to be licensed when conducting real estate transactions in the United States and many other countries. Lift Credit offers installment loans up to 2500 and has some of the highest rates on this list the first time around.

Second mortgages come in two main forms home equity loans and home equity lines of credit. The co-branded Home Depot Consumer Credit Card and Home Depot Project Loan but you can also tap traditional payment options like a zero-interest credit card or a personal loan. If you are in the middle of a home remodel and youre thinking of a tiny home or even a pole barn structure Acorn Finance can get you the financing you need.

Whether you use an unsecured personal loan or credit card for furniture financing your credit score may be impacted. Bangkok September 6 2022 Bitkub Blockchain Technology Bitkub Chain and Bitkub NFT developer invite you to open the new experience of the digital world and participate in the NFT activities at Bitkub NFT Fair event on September 10-11 at Bitkub M Social Helix Building 9th floor The Emquatier. So if you have bad credit furniture financing could actually help you improve your situation.

Low Income Mortgage Loans For 2022

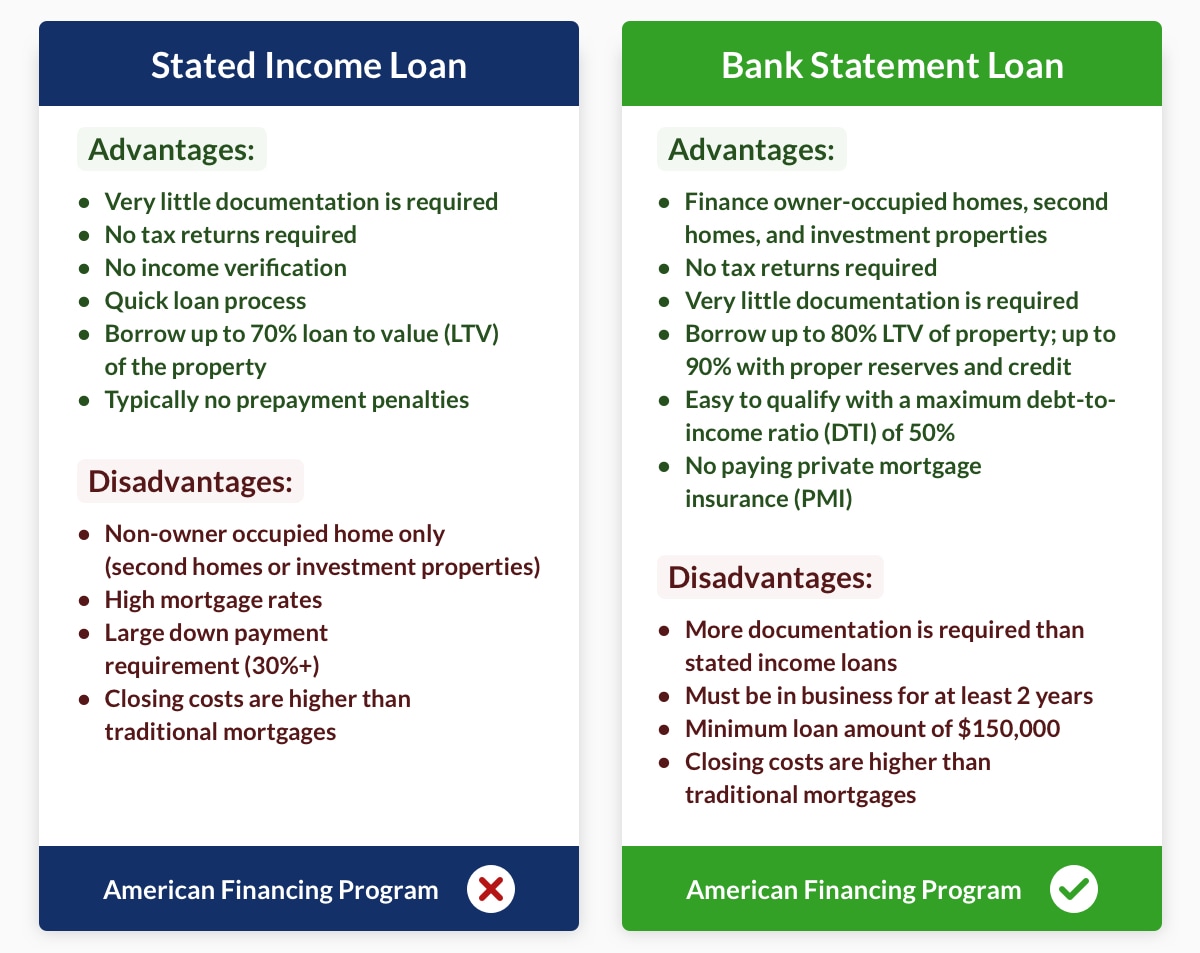

Stated Income Loans And More For Self Employed Borrowers

How To Get A Bad Credit Home Loan Lendingtree

Get A Home Equity Loan With Bad Credit Lendingtree

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

5 Best Loans For Bad Credit Of 2022 Money

How To Get A Home Equity Loan With Bad Credit Forbes Advisor

The Best Home Improvement Loans With Bad Credit Bankrate

8 Best Mortgage Refinance Companies Of Sept 2022 Money

Can You Get A Bad Credit Home Loan Credit Karma

How To Get A Bad Credit Home Loan Lendingtree

/mortgage-final-7b53158e65944796a0f896b2ff335440.png)

What Is A Mortgage

How To Get A Mortgage 7 Steps To Success Forbes Advisor

5 Best Mortgage Lenders For Bad Credit Of September 2022 The Ascent

Mortgage Hard Money Associates Home Loan Of Florida Inc

5 Best Mortgage Lenders For Bad Credit Of September 2022 The Ascent

Can You Get A Loan For A Down Payment On A Home Nextadvisor With Time